I hate paying fees to banks for anything. In my mind banks are evil. And this means I try to do everything I can to not pay them. I bet you do too.

Here’s the problem. They always win and we just pay up. And we often forget they are not in business for the benefit of you or me. They are in it for their shareholders. But we are constantly talking about interest rates and how horrible banks are to charge us more interest. We know higher interest rates means you pay more.

If today you took out a bank loan for 25 years for $800,000 with a constant interest rate of 5.6% you will pay the gigantic amount of $1,488,177 ($800,000 loan plus interest of $688,177). The interest you repay back is almost as much as the loan. A 2% increase will mean the interest amount increases the interest element to $989,219 a whopping $301,000 more.

But rarely do we ask our investment portfolio manager what their charges are. It is usually tucked away in clause 458 on page 32.

But 1% damage that can be done by rising interest rate do just as much damage as a 1% increase in the charges by an investment manager. So, they should be kept in check too.

And just like banks they have different ways of charging.

Some fees are necessary to cover the costs of managing your investments, but excessive fees can be a significant drain on your long-term returns.

I recently advised you of what some superannuation funds were charging. It should be shocking but nowadays it does not shock me. I just sigh and shake my head knowing millions, if not billions are ripped out of hard-working people’s hands.

The damage of charges are done because you have less to compound. Compounding interest can generate substantial growth in your investment portfolio over time. But excess fees reduce your returns which mean your portfolio values suffer.

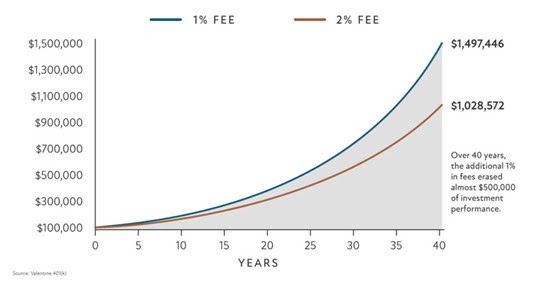

The table below shows more.

The chart above shows the growth of two hypothetical portfolios, each with an initial $100,000 investment, over 40 years. The first portfolio has a 1% fee and the second portfolio has a 2% fee. Over 40 years, the 2% fee portfolio erased almost $500,000 of investment performance when compared to the 1% fee portfolio.

What should you/ can you do?

1. Understand and compare fees

Spend time and review fees. But do not assume lowest fees are best. Finding the right balance is right.

Take time to understand exactly what fees you’re paying and what you’re receiving in return.

Speak to your advisor at Wow Advisors to get expert guidance. Review investment prospectuses and fee disclosure documents, and compare the fees of various low-cost investment vehicles, such as index funds and exchange-traded funds (ETFs).

Make sure the fees you’re paying for a given investment are justified. Eg it is worth paying 2% fees if they generate routinely 10% returns. But it probably is not great if they are charging 1% but only giving 4% returns.

2. Watch out for transaction fees

Transaction fees refer to charges when buying or selling investments, such as individual stocks and bonds. If you make frequent trades, these fees can quickly add up.

Historically we have found that share trading (people who constantly buy and sell) do not do as well as those that buy and hold. This is because if you hold you do not have to pay taxes on any growth. And the more you trade the more you pay in buying or selling those investments. You may end up paying capital gains taxes on top too.

3. Regularly review

While it’s smart to take a long-term approach when developing your portfolio, it’s also important to regularly review and rebalance your portfolio to ensure it continues to align with your financial goals and risk tolerance.

The rebalancing process can also help you identify and eliminate underperforming funds or investments with high fees to help optimize your returns.

4. Work with a fee-based advisor

We like fee based advisor Fee-based advisors get paid based on the assets they manage on your behalf. They don’t make commissions on investment sales, nor do they charge transaction fees.

But we like them because it also eliminates potential conflicts of interest. Because the advisor’s fee grows in proportion with your portfolio, he or she is incentivized to maximize your investment returns, which aligns the advisor’s goals with yours.