You would have to be a hermit if you did not know that Australia (and the world) is going through a rocky patch on the financial front.

The share market recently tanked freaking out everyone, including those on pensions or about to become pensioners. Homeowners are freaking out because interest rates are up and will continue to go up. Everyone is worried about the cost of living which is also up and business owners are concerned that award rates and the minimum wage rates will go up at a time when maintaining and holding staff is not only a challenge but near on impossible. And that is before their landlords come knocking on the door asking for their CPI rent raises.

The media would let you believe that all is lost with the economy doomed and we will all be penniless and homeless.

But as generations before us, a couple of world wars, numerous recessions with all the doom and gloom have shown us that eventually we come out stronger.

Yes, some will suffer. Some will lose homes as they have pushed themselves to the limits they should not have. Others will make poor financial decisions borrowing to feed spending habits which were affordable in low interest rate environments but don’t make sense now.

House prices may fall. The stock market may fall, asset prices may fall. And that may be bad for those holding them and even worse for those who may be forced to sell them.

But for those who don’t panic and were sensible it is usually the best time to buy. Or so say the real experts. And I am not one of them.

Historically investments have outperformed anything else.

Recently I was watching morning TV, which is not recommended, but when you are in a waiting room with not much to do you somehow get drawn in. Anyway, it showed what would be the result of investments if you had invested $10,000 ten years ago.

This is what they said the value of assets would be today if you invested $10,000 ten years ago.

| International shares | Approx. $47,000 |

| Australian property | Approx. $36,000 |

| Australian shares | Approx. $27,000 |

| Cash |

Approx. $12,000 |

Please note, I have not verified these figures so do not know for sure if they are true.

Cash may be deemed safe, but in low interest rate environments, it is a poor performer. In fact, research for my next book The Passport to Real Wealth & Financial Freedom if you invested $1 in cash on 1 Jan 1900 it would be worth (drum roll please) a crappy $242!

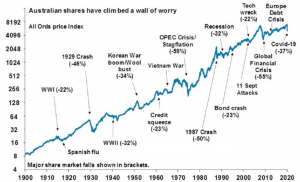

The table below shows what the stock market has done during the same time

If you invested $1 in the Australia stock market on 1 Jan 1900 it would be worth a whopping $485,000 today (approximately).

And that is after two world wars, the depression, the Spanish flu, the Vietnam war, the oil crisis, the 1987 crash, the global financial crisis and now COVID-19.

So yes, the doom and gloom we are hearing is bad. But probably not as bad as we are led to believe.

In the financial world we are in winter where nothing grows and many things die. But eventually spring and summer come and things look rosy again. It’s a cycle. Your objective is to get through the winter, invest and watch it grow as spring and summer come. Because spring and summer always follow winter.

There is a saying in finance. When everyone jumps in, it’s usually the time to jump out. And if you read the media it seems every Tom, Dick and Harry was jumping in whether it is Crypto, Property or the Share Market.

What should you invest in? I haven’t got a clue. Actually, I do, but that is a discussion you need to have with your financial planner. That’s because I am not a financial planner which means if I say something every federal and state regulator in the country will ensure I am disembowelled, shamed, humiliated, and suffer.

I would love to make a difference for you, but I don’t love you that much. What I have said above is general in nature and is historical.

Building wealth is something that can happen during good times and bad. It’s just that during the bad times you need to be more informed. Which means you need to have good advisors.

If you want to build wealth it will not come from earnings. It will come from long term sustainable and sometimes boring investing.

If you would like to meet one of our Financial Planners so you are able to navigate this winter season get in touch.