Bookkeeping tracks your day-to-day transactions. Accounting uses that data to help your Brisbane business stay compliant, plan ahead, and grow confidently.

At WOW! Advisors, we know that many Brisbane business owners—from freelancers and retailers to growing companies—often ask the same thing:

“What’s the actual difference between accounting and bookkeeping?”

While both are essential, they serve different purposes. Bookkeeping focuses on accurately recording your financial activity. Accounting interprets that information to support smarter decisions, tax planning, and business strategy.

Let’s break down the key differences, why you need both, and how our team provides complete financial clarity through our annual accounting services in Brisbane.

What is Bookkeeping?

Bookkeeping is the process of recording every transaction your business makes.

It includes:

- Tracking income and expenses

- Entering invoices and receipts

- Recording payroll, super, and bills

- Reconciling bank accounts

- Keeping data current in Xero or MYOB

In Brisbane, proper bookkeeping is more than just good practice—it’s required by the ATO. If you don’t maintain accurate records, it can lead to incorrect BAS lodgements, missed deductions, or even penalties.

At WOW! Advisors, our Brisbane bookkeepers ensure that nothing gets missed. We keep your data organised, up to date, and compliant—so your financial foundation is always strong.

What Does Accounting Do Beyond Bookkeeping?

Once your books are accurate, accounting turns that raw data into meaning.

Accounting is the interpretation and reporting of financial information. It transforms your bookkeeping into:

- Profit and loss statements

- Balance sheets

- Cash flow forecasts

- Business tax returns

- Strategic financial advice

Our Brisbane accountants help you identify tax-saving opportunities, prepare for year-end, manage risk, and plan for growth. Whether you’re hiring, expanding, or applying for funding, accounting gives you the insight to move forward with confidence.

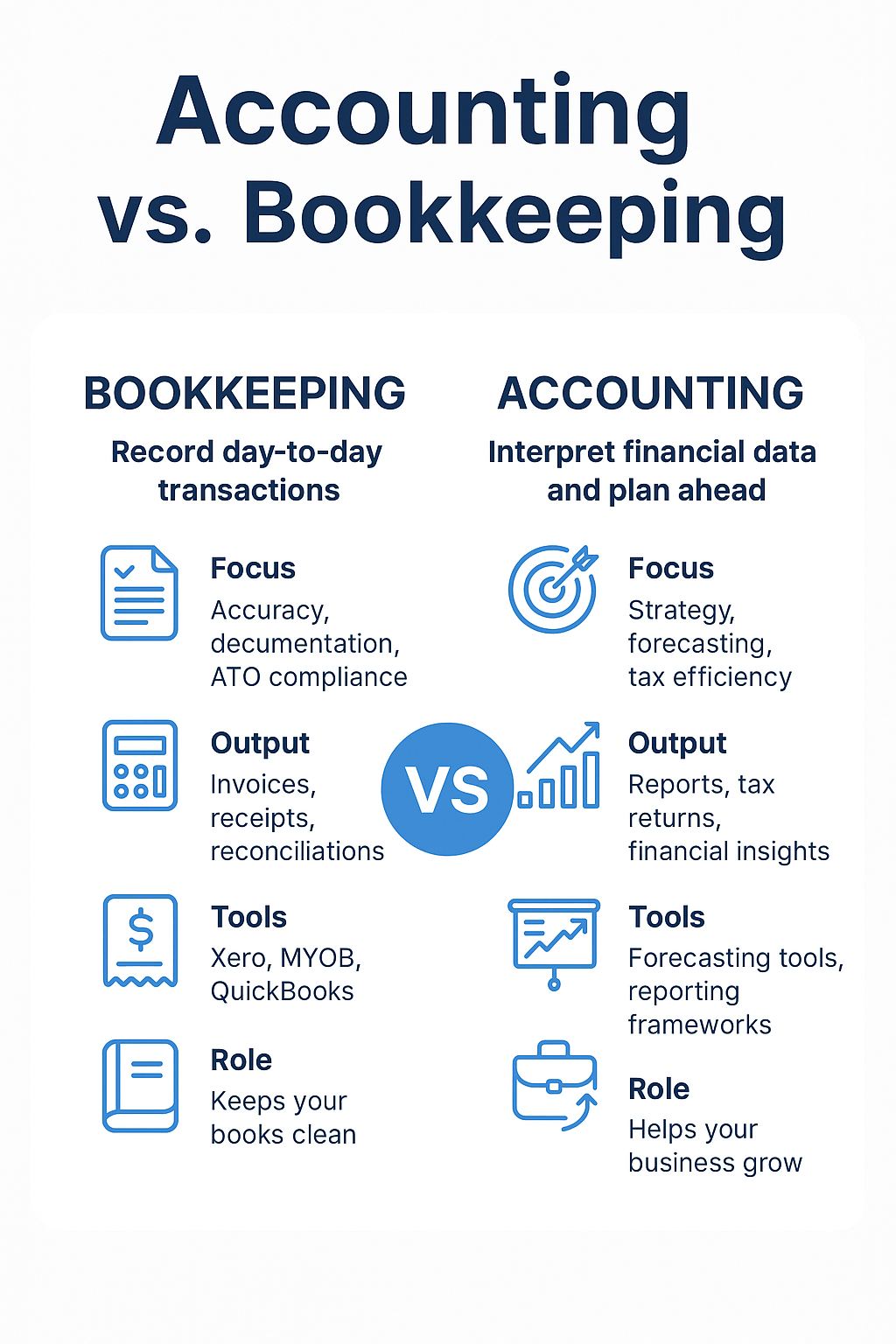

Bookkeeping vs. Accounting: A Quick Comparison

| Aspect | Bookkeeping | Accounting |

|---|---|---|

| Purpose | Record day-to-day transactions | Interpret financial data and plan ahead |

| Focus | Accuracy, documentation, ATO compliance | Strategy, forecasting, tax efficiency |

| Output | Invoices, receipts, reconciliations | Reports, tax returns, financial insights |

| Tools | Xero, MYOB, QuickBooks | Forecasting tools, reporting frameworks |

| Role | Keeps your books clean | Helps your business grow |

How WOW! Advisors Combines Bookkeeping and Accounting

While bookkeeping and accounting are different, they work best when they’re closely connected.

At WOW! Advisors:

- Our bookkeepers keep your records accurate and timely

- Our accountants use that data to deliver strategic insights and compliant reporting

This teamwork ensures that your business stays on track throughout the year—not just at tax time. When it comes to year-end, your financials are already in great shape. That’s the power of our annual accounting services in Brisbane—you’re never playing catch-up.

Who Needs Accounting and Bookkeeping in Brisbane?

Most Brisbane businesses need both, regardless of size or industry. Whether you’re:

- A startup managing early growth

- A local café processing daily transactions

- A freelancer with multiple clients

- A consultant tracking super and payroll

- An investor managing multiple income sources

you’ll benefit from having structured bookkeeping and expert accounting working together. Even if you use accounting software, without oversight, you risk data gaps and missed opportunities.

At WOW! Advisors, we support businesses across Brisbane with tailored solutions that scale as you grow.

What Are Annual Accounting Services in Brisbane?

Every Brisbane business must lodge accurate financial reports annually.

Our annual accounting service includes:

- Profit and loss statement

- Balance sheet

- Tax return preparation

- Cash flow review

- ATO and ASIC compliance

- Final BAS lodgement

- Strategic business review

Whether you’re a company, trust, or sole trader, we handle all reporting and ensure that everything is submitted on time—with no stress or surprises.

Why Choose WOW! Advisors?

At WOW! Advisors, we go beyond compliance—we help you grow with clarity.

Here’s what sets us apart:

- Fixed-fee pricing with no surprise bills

- Local Brisbane experts who know state and ATO rules

- Xero and MYOB specialists

- Unlimited phone/email support

- A single point of contact for all your services

- Bookkeeping and accounting under one roof

You’re not just outsourcing tasks—you’re gaining a financial partner who supports your long-term goals.

Final Thoughts: Do You Need Both Accounting and Bookkeeping?

Yes—both services are essential. Bookkeeping ensures your records are reliable. Accounting helps you make confident decisions with that information.

Together, they create the financial clarity every business needs.

At WOW! Advisors, our bookkeeping and accounting teams work together seamlessly to support your Brisbane business—day-to-day and year-end.

Ready to simplify your finances? Book your free consultation with WOW! Advisors and discover how our annual accounting services in Brisbane can help your business thrive.

Frequently Asked Questions

Which is better—accounting or bookkeeping?

They serve different roles. Bookkeeping keeps daily records accurate. Accounting turns that data into strategic decisions. Most businesses need both to succeed.

How much does bookkeeping cost in Brisbane?

Rates range from $25 to $250/hr based on scope and experience. We offer affordable fixed-fee packages for transparent, ongoing support.

What types of bookkeeping services are available?

- General bookkeeping

- Payroll and superannuation

- BAS preparation

- Accounts payable and receivable

- Financial reporting

We offer all these services in-house.

Can I just do bookkeeping and skip accounting?

Technically yes, but without accounting, you miss out on planning, forecasting, and tax optimisation. We recommend combining both for best results.

How do I choose the right bookkeeper in Brisbane?

Look for someone experienced with ATO rules, familiar with your industry, and confident using cloud software. At WOW! Advisors, our bookkeepers meet all of those standards.

How often should I update my books?

Ideally every week—daily if you have many transactions. We ensure timely updates so you always know where your business stands.