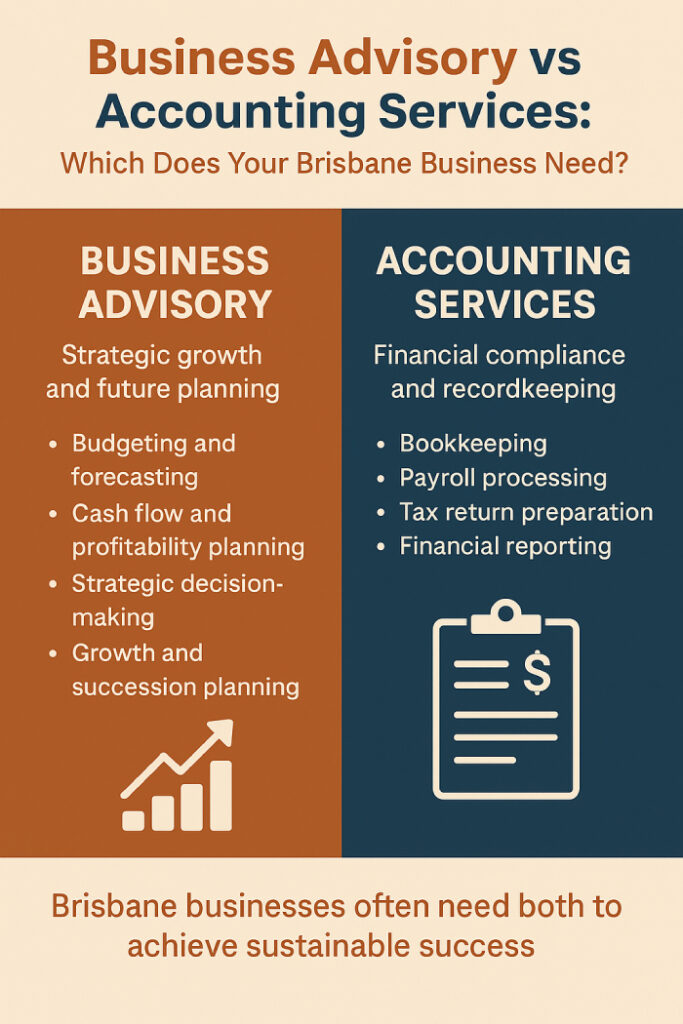

Business advisory services focus on strategic growth and future planning, while accounting services ensure financial compliance and accurate recordkeeping. Brisbane businesses often need both to achieve sustainable success.

Running a business in Brisbane means juggling cash flow, compliance, strategy, and operations. While every business needs an accountant to stay on top of financial records and tax obligations, many also benefit from business advisory support focused on strategy, profitability, and long-term planning.

In a growing economy like Brisbane—spanning industries such as construction, healthcare, technology, and retail—the demand for sound financial strategy is higher than ever. That’s why understanding the difference between essential accounting services and the broader scope of business advisory is so important. Accounting focuses on past performance and compliance; advisory focuses on future planning and growth.

What Are Accounting Services and How Do They Support Brisbane Businesses?

Accounting services handle day-to-day financial tasks that keep your business compliant with tax laws and regulations. For Brisbane-based businesses, these typically include:

- Bookkeeping

- Payroll processing

- BAS and GST lodgements

- Tax return preparation

- Financial reporting

Accountants ensure that obligations to the ATO and other authorities are met accurately and on time.

At WOW! Advisors, we see accounting as the financial backbone of your business. It ensures compliance, maintains accurate records, and reflects your business’s financial health. Accounting is generally reactive addressing transactions that have already occurred. Whether it’s reconciling your bank accounts or preparing quarterly BAS, this work lays the foundation for smarter business decisions.

However, if your business ambitions extend beyond staying compliant, that’s where business advisory comes in.

What Is Business Advisory and Why Is It Crucial for Brisbane Businesses?

Business advisory is proactive. It’s about helping you make smarter decisions using financial data. Rather than simply recording past transactions, advisory services interpret your numbers to guide future success.

At WOW! Advisors, our business advisory services empower you with insight and action. We support Brisbane businesses in areas such as:

What Is Business Advisory and Why Is It Crucial for Brisbane Businesses?

Business advisory is proactive. It’s about helping you make smarter decisions using financial data. Rather than simply recording past transactions, advisory services interpret your numbers to guide future success.

At WOW! Advisors, our business advisory services empower you with insight and action. We support Brisbane businesses in areas such as:

- Budgeting and forecasting

- Cash flow and profitability planning

- Business structuring and scenario planning

- Strategic decision-making

- Growth and succession planning

- Tax minimisation strategies

These services help identify risks, uncover opportunities, and set a clear financial direction. Unlike accounting, which reports on what has happened, business advisory shapes what happens next.

Key Differences Between Accounting and Business Advisory Services in Brisbane

Here’s how the two services differ:

| Accounting | Business Advisory |

|---|---|

| Compliance-focused | Strategy-focused |

| Tracks past data | Plans for the future |

| Delivers financial statements, tax returns | Provides insights, KPIs, cash flow forecasts |

| Periodic engagement | Ongoing collaboration |

| Ensures legal accuracy | Enhances decision-making & growth |

At WOW! Advisors, we view accounting as your business’s solid foundation, and business advisory as the layer that builds your future success.

Do You Need Business Advisory or Accounting Services for Your Brisbane Business?

Most Brisbane businesses benefit from both. The need depends on where your business is in its journey:

- Start-up or early-stage? You may need help with compliance tasks like BAS lodgement, payroll, and tax returns making accounting services essential.

- Planning to grow or restructure? Then you need guidance on forecasting, profitability, and investment decisions making advisory services more relevant

If you’re unsure, check out our article: 5 Signs Your Brisbane Business Needs a Business Advisor.

At WOW! Advisors, we serve many Brisbane businesses with both services, helping them stay compliant while planning strategically for the future. We understand the local business landscape, industry-specific challenges, and the need for a personalised financial roadmap.

At WOW! Advisors, we serve many Brisbane businesses with both services, helping them stay compliant while planning strategically for the future. We understand the local business landscape, industry-specific challenges, and the need for a personalised financial roadmap.

Why Are Business Advisory Services Essential for Long-Term Success?

In today’s competitive market, accurate books alone aren’t enough. Businesses need clarity, direction, and agility. That’s what business advisory offers.

At WOW! Advisors, we collaborate with clients to define success and build a strategy that supports that vision. Business advisory adds unique value by:

At WOW! Advisors, we collaborate with clients to define success and build a strategy that supports that vision. Business advisory adds unique value by:

- Identifying inefficiencies and cost-saving opportunities

- Uncovering new revenue streams

- Helping you scale or exit with confidence

- Offering regular check-ins to adjust to market shifts

This forward-thinking approach helps you stay prepared, informed, and proactive—rather than reactive.

Conclusion: Strengthen Your Brisbane Business with Both Services

Accounting and business advisory each play crucial roles in your business’s success. Accounting ensures compliance and accuracy. Advisory transforms insights into actions, helping you grow, innovate, and prepare for what’s next.

At WOW! Advisors, we offer both under one roof—so you don’t have to choose between compliance and strategy. Whether you’re preparing for growth, planning a succession, or simply wanting better financial clarity, we’re here to help.

Book a consultation with WOW! Advisors today and let’s create a financial strategy tailored to your business’s future.

At WOW! Advisors, we offer both under one roof—so you don’t have to choose between compliance and strategy. Whether you’re preparing for growth, planning a succession, or simply wanting better financial clarity, we’re here to help.

Book a consultation with WOW! Advisors today and let’s create a financial strategy tailored to your business’s future.

Frequently Asked Questions

Do small businesses need to worry about accounting?

Yes. Even small businesses must track income, expenses, and taxes. As your business grows, accounting becomes more complex. A professional accountant ensures compliance and provides insights to support long-term growth.

Is it better to have an accountant or a financial advisor?

It depends. Accountants help with tax, payroll, and business finances. Financial advisors are best if your focus is on personal wealth, superannuation, or retirement planning.

What’s the difference between an accountant and a CPA?

A CPA (Certified Practising Accountant) has completed additional exams and met strict licensing standards. They typically offer deeper expertise in taxation, audits, and complex reporting than a general accountant.

How do I measure the ROI of business advisory services?

ROI can be seen in improved profitability, better cash flow, reduced costs, and stronger long-term financial performance.

Can a business advisor help with funding or loan applications?

Yes. Advisors can help you prepare business plans, financial forecasts, and supporting documents to improve your chances of approval.

Can one firm offer both accounting and advisory?

Absolutely. At WOW! Advisors, we provide both services—so you get compliance and strategic guidance in one place.